Realtor Fernando L. Baez proposes to rethink the Puerto Rico Real Estate Industry with two measures: Puerto Rico should be marketed in the United States as an ideal place to have a second home and to purchase a home to retire. Along with this initiative, the government could increase incentives to attract US banks wishing to settle in Puerto Rico and thus inject capital for mortgage loans.

Realtor Fernando L. Baez proposes to rethink the Puerto Rico Real Estate Industry with two measures: Puerto Rico should be marketed in the United States as an ideal place to have a second home and to purchase a home to retire. Along with this initiative, the government could increase incentives to attract US banks wishing to settle in Puerto Rico and thus inject capital for mortgage loans.

“With these two initiatives, Puerto Rico’s sluggish economy can quickly take off,” said Baez, president of real estate company Baez & Associates Real Estate.

“What Florida did in the 1980s and 1990s, marketed as a retirement home and second homes in the United States and Canada, is what Puerto Rico must do now. With the advantage that properties in Puerto Rico are at a better price right now than in other places in the United States and in other countries where Americans buy to retire, “Báez explained.

According to information compiled by the real estate expert, about 8 million US citizens live outside the United States. The country where they most tend to move is Mexico, where one million Americans live, followed by Canada and the Philippines. Báez says that they should be encouraged to move to Puerto Rico, because for Americans there are advantages here, which have not been explained to them.

“Puerto Rico has not been properly marketed and exposed to the world. We have and belong to the best and largest market of buyers that are currently: the citizens of the United States. Puerto Rico is a paradise for its climate, in an excellent location in the Caribbean, with easy financing and with the security of being a territory of the United States, the country of which they are citizens. Here they have the same currency, they do not need a visa, they have the ease of English and the mail. The biggest attraction Puerto Rico has is being used as a place of housing, either as a retirement site or as a second home for vacation, “explained Báez.

The real estate expert argued that, in terms of mortgage banking, these US citizens who are looking to invest in a second home or retirement location outside of the United States are people with solid incomes, buyers with money to buy immediately, and They do not need local source of employment for the transaction.

A boost to the economy

For Puerto Rico’s economy to attract these buyers has enormous advantages, because when they move to the Island, they will be creating direct and indirect jobs in services for their homes: buying furniture, appliances, painting, household goods, cars, going to supermarkets And restaurants, among other investments. As the population increases, particularly if they are older, they would also increase the medical class in Puerto Rico, because of the need to have health services. In addition, these new buyers will be promoting tourism in the island, as they are here, relatives and friends will come to visit them, said the realtor

Báez carried out an analytical study that he shared in a recent presentation to professionals in the real estate sector and mortgage banking. In the same, he compared the conditions of Puerto Rico, as United States territory, with those of Spanish-speaking countries to which Americans move: Mexico, Dominican Republic, Colombia, Panama and Costa Rica. These countries are marketed with commercials and videos in traditional media and digital media in the United States to search for buyers of their properties. That marketing is an advantage they have over Puerto Rico.

Even so, Puerto Rico has advantages over these. For example, in contrast to Puerto Rico (which has very low interest rates of around 3% and very low or no offers at the moment), for a mortgage in the Dominican Republic, it would soon have to be a 30% initial contribution, Amortization is 15 or 20 years, interest is between 8 and 10%. It is not financed to people over 65 years and the properties to be financed are only in exclusive tourist or residential places. In Mexico, the sooner they are required is 20% and, if they are looking for low interest, the sooner is 30% and 40%. Amortization is 15 or 20 years and interest fluctuates between 7.5 and 10%. Outside the tourist or residential areas, the purchase of properties would have to be in cash. Do not mortgage people over 65.

As for financing, contrary to what would happen in other countries, there are many mortgage products for which these buyers of the United States qualify: FHA, 203K, Veterans, conventional, reverse mortgage and Magic and Fannie Mae loans, “he said. Báez. He added among the advantages of Puerto Rico that the cost of the properties has declined, that the constructions in cement are more secure and that the properties can be resold without major complications reason why they are good investment.

Likewise, Baez’s study evaluated the promotion of properties of other Caribbean islands, including the Virgin Islands. In these it emphasizes that they are territories of the United States, when emphasizing that they are U.S. Virgin Islands, something that does not currently do Puerto Rico.

Attract the US bank. UU.

Báez also stressed the need for the government to attract more US banks to Puerto Rico. “In the past we had a strong commercial bank and a very solid mortgage bank,” said the realtor, indicating that there are now many less commercial banks and mortgage houses. The result of this, given the economic fragility of the island, is that banks are much more reluctant to approve loans and this damages both the mortgage market and the economy in general.

“The Development Bank would give me an assignment to bring all the banks in the United States and give them incentives to set up here. We want economic development in Puerto Rico, but we must start with financing. If no money for loans can not be developed. At the same time there is money to lend, the economy moves, “he said.

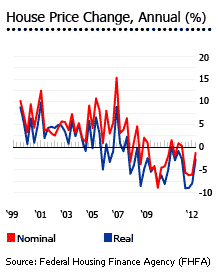

Puerto Rico’s house prices fell by 1.3% (2.66% in real terms) y-o-y in the second quarter of 2012, according to the Federal Housing Finance Agency (FHFA), a decline noticeably lower than during each of the previous three quarters, which saw average price falls of 5.9% y-o-y (8.7% in real terms).

Puerto Rico’s house prices fell by 1.3% (2.66% in real terms) y-o-y in the second quarter of 2012, according to the Federal Housing Finance Agency (FHFA), a decline noticeably lower than during each of the previous three quarters, which saw average price falls of 5.9% y-o-y (8.7% in real terms).